2022 could be the turning point for lab-grown diamonds

Post Date: 28 Jul 2022 Viewed: 396

In 1947, amidst reports of a new ‘cold’ war brewing and inflation hitting 14%, De Beers completely changed the world of diamonds with their advertising campaign ‘a diamond is forever.’

Those four little words have left their mark on history which has remained to this day, writes Robert McKenzie, director of growth at ethical jewellery brand Nightingale.

Today, we’re all too familiar with rising inflation and mounting world tensions. So, is 2022 the year for another seismic shift in the world of jewellery? This time fuelled by lab grown diamonds.

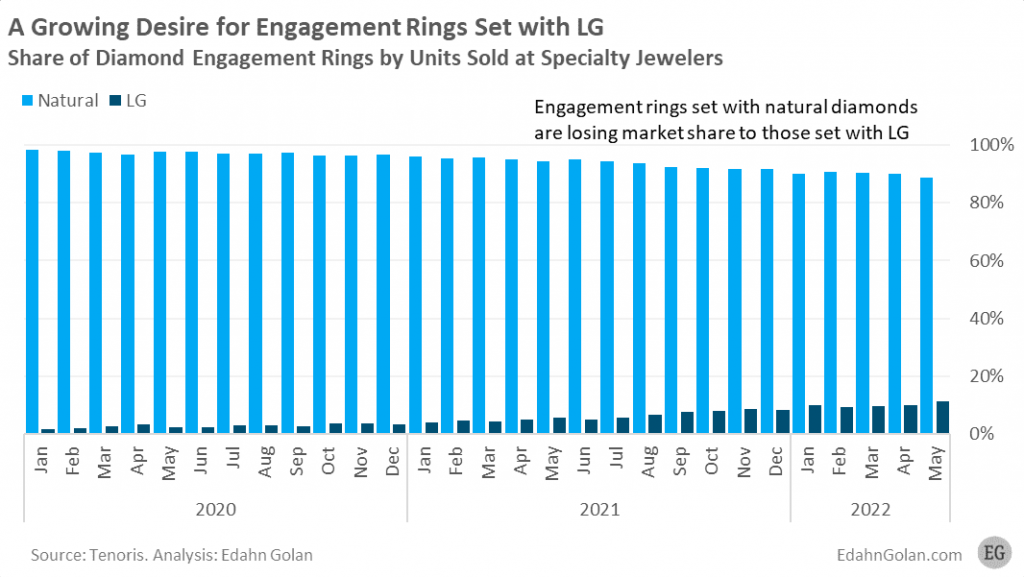

Lab grown diamond demand market share continues to rise

We’re half way through the year and we’ve already seen massive shifts in the way customers are buying.

At Nightingale, we’ve always had lab grown diamonds make up 80% of our sales, but we’ve never seen overall demand higher than it is right now.

We’re seeing a similar pattern across the industry too:

- In the US, lab grown diamonds accounted for 3% of all speciality jeweller sales in 2020. At the time of writing, it has risen to 7%.

- Large high street brands in the UK, such as Pandora, have launched lab grown collections of their own.

- l Even retailers who historically sold mined diamonds have seen huge swings in demand. Queensmiths recently announced that lab grown diamonds switched from 1% of sales to 53% in two years!

A rise in jewellers’ offering lab grown alternatives has occurred purely due to customer demand, despite organisations like the Natural Diamond Council launching campaigns led by Ana De Armas attempting to turn consumers back to mined diamonds.

Predictions for the second half of 2022

By all measures and predictions the UK is heading towards a recession.

It’s very likely that we’ll see the average budget for engagement rings reduce due to lower disposable income and an increase in the cost of finance options due to rising interest rates.

We expect lab and mined diamond jewellery will see a similar budget squeeze because historically customers have chosen to simply buy larger lab diamonds, and not reduce the budget they were going to spend on a mined equivalent.

However, we predict more customers will consider lab grown diamonds than in previous years. As well as lab grown diamonds being normalised in recent years, the halo effect smaller jewellers are experiencing from the bigger brands will continue to grow.

Perhaps the most compelling development is the LVMH group investing heavily into an entirely solar powered lab diamond producer.

LVMH owns some of the world’s highest profile luxury brands including Tiffany, Bulgari, Marc Jacobs and Christian Dior. It certainly puts lab grown diamonds in the right company, firmly cementing their place as a luxury product.

At Nightingale we firmly believe that 2022 will be a transformative year for lab diamonds, and as the UK’s first jeweller to sell lab grown diamond engagement rings, we’re so happy to be part of what’s to come.

At Nightingale we firmly believe that 2022 will be a transformative year for lab diamonds, and as the UK’s first jeweller to sell lab grown diamond engagement rings, we’re so happy to be part of what’s to come.